Happy Thanksgiving to all those who celebrate. So much to be thankful for this year with the crew GSJ Consulting – so a big shout out to all those who are helping us out on our journey of a thousand steps!

Yesterday (13/11) was World Kindness Day, and while I think that’s a great idea/concept – with the level of mental health issues that we have in the legal profession, you have to ask yourself:

Why doesn’t every law firm office have one of these benches?

I put a post up last week on LinkedIn, off the back of a very interesting blog by Jordan Furlong on his Substack feed: ‘The legal world in 10 years (if we’re really lucky)‘, that got some social media traction so I thought I would re-share here.

At the heart of my LinkedIn post was a comment Jordan makes on – what he calls – High-Value Retainers and the effect Gen AI will have on these fee arrangements. To quote:

High-Value Retainers

Thanks to Gen AI’s consumption of many traditional tasks, lawyers have moved up the value ladder, going beyond “bet-the-company” and “run-the-company” work to start offering “grow-the-company” work (or “advance-the-individual”). These are engagements in which lawyers ask: “How can I improve your situation? What are your near-term and long-term goals? How can I help you anticipate problems and prevent them before they happen? How can I bring you more stability and peace of mind? How can I be your advocate and counsellor in whatever you need?”

While I think Jordan’s point is an excellent one, mine was this: “Do you think this could work in 10 years time?“

Because if you think it could: Why are you waiting 10 years for AI to develop in order to have this conversation – have this conversation with your clients now!

In that, it’s not a 10+ years from now discussion. It’s not a 10+ years from now problem. It’s a HERE AND NOW problem and a here and now discussion.

Tesla, Elon Musk’s EV carmaker, published its Q3 results earlier today (Australia time). Profits plunged 44 per cent. But, from my perspective this was the interesting part: “after it cuts prices to boost sales“.

Let’s unpack that for a second: Tesla “slashed prices by around 25 per cent in the United States during the last year” – “putting the priority on sales rather than profit“.

As it happens, this is also a common trait of professional services firms: prioritizing getting the deal done over making an actual profit – including agreeing to heavy “volume discounts”.

As the Tesla results show though, any price discount you give comes directly from profit – not sales revenue.

So the price discount you offer your clients is essentially compounded on your bottom line – 10% is not 10%, it’s more like 30%.

Or in the case of Tesla: a 25% price discount has resulted in a 44% plunge in profit.

Something to think about when you are next thinking about what pricing options you have available to you.

And please, don’t follow this advice:

“I view it as a way to defend market share at the expense of margin” .

Kevin Roberts, director of industry insights and analytics at CarGurus, an online auto sales site

In professional services firms, market share should never Trump (pun intended) profit.

As usual, if you need any help with any of this, feel free to reach out.

This is a REALLY telling – and valuable – statistic from ‘Building client feedback programs that lawyers love: What CMOs say‘ by Jen Dezso – Director of Client Relations / Thomson Reuters:

Let’s get a realty check on that: Law firms that have a client experience (CX) feedback program can earn nearly twice the share of a client’s wallet, but less than one in three clients have been asked to participate in a client feedback program.

In business development we often talk about “low hanging fruit” and this seems like a ‘no brainer’ to me!

Get in touch if this is something that interests you. And, frankly, why should it not!

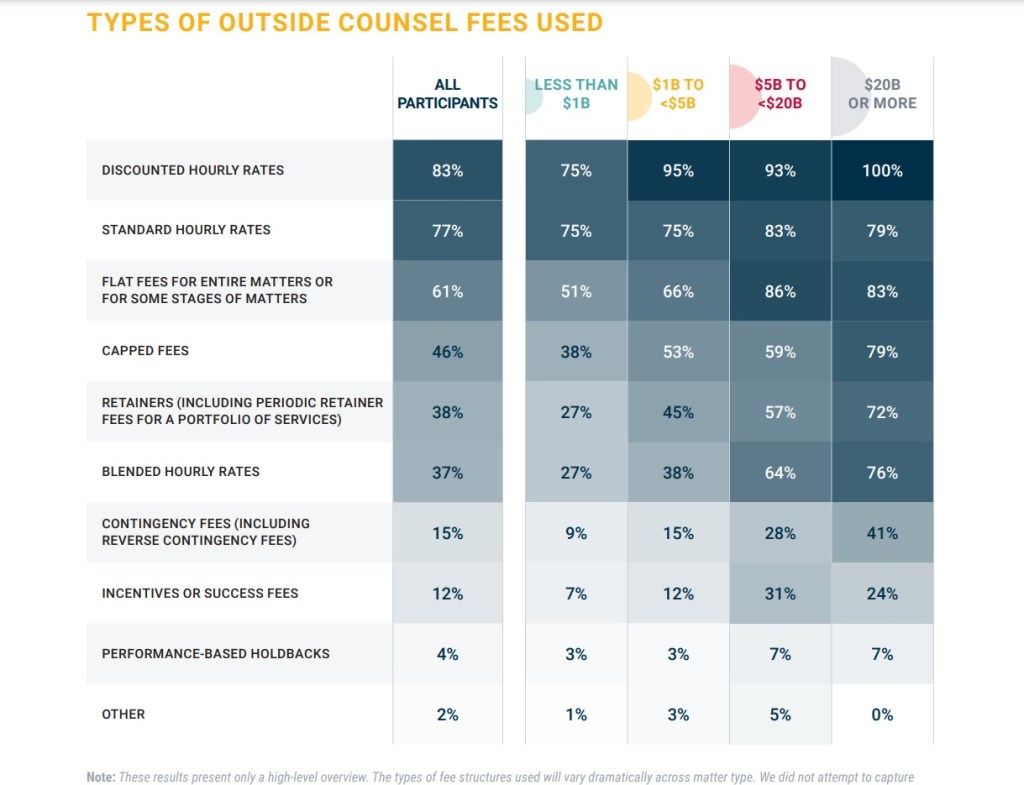

If you are wondering what types of Alternative Fees Arrangements (AFAs) in-house General Counsel are asking their private practice suppliers to provide them with – or, to flip the coin, what AFAs private practice lawyers are charging their in-house GCs, then wonder no longer. The latest market report from the Association of Corporate Counsel (ACC) sets this out in a nice clear table:

Some take-aways:

Importantly though, despite talking about implementing AFAs for over two decades, we are still a long way off actually using them in practice.

Again, take a look at my linked article above where I talk to Patrick Johansen’s Continuum of Fee Arrangements™, where Patrick sets out 16 different types of fee arrangements that can be used:

And ask yourself, how many of these are being actively used in this latest report from the ACC?

Notably missing from the list above? Value Based Billing!

Yes, despite what you may read and hear elsewhere, in practice we are long, long way away from understanding and implementing the appropriate (a term I learned from Toby Brown) use of relevant fee arrangement for the task at hand.

In-house or private practice, if you’re struggling to get to grips with this issue, feel free to reach out to me for a chat.

Ever wondered if there is a difference between ‘customer service’ and ‘customer experience’?

I was fortunate enough to come across this quote by Paul Roberts, CEO at My Customer Lens that, frankly, sums it up better than anyone else I have seen lately:

“It’s important to define the difference between customer service and customer experience. I like to define customer service as what you do, and customer experience is how you make people feel.”

Too often in professional services firms we concentrate on the ‘customer service’ at the expense of the ‘customer experience’; when the reality is that we should be much more focused on the customer experience than we are on the customer service.

As the article states:

“Improving the client experience is about looking at the entire client journey, from initial enquiry through to case completion, and beyond. It’s a rethink and review of every customer touchpoint throughout your organisation; from the way the phone is answered, to your hold music, reception waiting room and website home page.”

Spot on advice.

If you or your firm is struggling to get a grip with this, feel free to reach out to me for a chat.

Woke up this morning – Australia time – to news that had broken overnight that Eversheds Sutherland (ES) and King Wood Mallesons (KWM) had entered into an exclusive alliance, along with a whole lot of DMs (Direct Messages) in my LinkedIn box asked me what my initial thoughts were.

So here I go with some initial, off the cuff, thoughts about this:

To me though, what will likely make or break this “formal cooperation agreement” however will be:

I guess we will have to wait and watch this space, but my three big observations are:

(1) Not sure what Eversheds is getting out of this deal – do KWM China refer that much work into UK, EMEA and South America?

(2) Looks to be a great deal for KWM China.

(3) Are KWM Australia being left in the wilderness?

Happy New Financial Year to all in #Auslaw.

It’s that strange time of the year when we start all over again as if the previous 12 months didn’t happen. Only it is not quite as simple as that. From today:

So while we are all enjoying the various EOFY parties over the next few weeks, or simply enjoying some downtime over the school holidays: keep in mind that you need to have a carefully crafted value message to explain to your clients why you justify that higher fee rate; and if you want to ensure that your realisation rate stays healthy I suggest it be better crafted than “we are in a new financial year”.

And if you are struggling with any of that, feel free to reach out to me for a chat.

Shoutout to Christine Jou on Unsplashed for the image

Came across the term “Burden partners” in this article in the Australian Financial Review today. “Burden partners” is a term denoting those partners within a partnership whose cost to the partnership is greater than their contribution.

In simple terms, partners who withdraw more from the kitty than they have deposited.

The reality is that by its very nature (due to economic cycles), there will – from time-to-time – be partners who have years in which they withdraw more than they have deposited that year; but in most cases these partners will have previously made significantly higher deposits than withdrawals and are effectively withdrawing savings (having said that, retained earnings is not a given with law firm partnerships so this is more a reputational issue than financial one).

It is circumstances in which this is a prolonged (and often unfixable) trend where this becomes a problem.

You can also often see this with new partners who have probably been made-up too soon and don’t really have the book of business yet to justify their promotion to partnership ranks.

Either way, if the term “burden partners” sounds familiar and you want to discuss ways of how this can be fixed, feel free to reach out to me for a chat.

Shoutout to Sean Stratton on Unsplash for today’s image