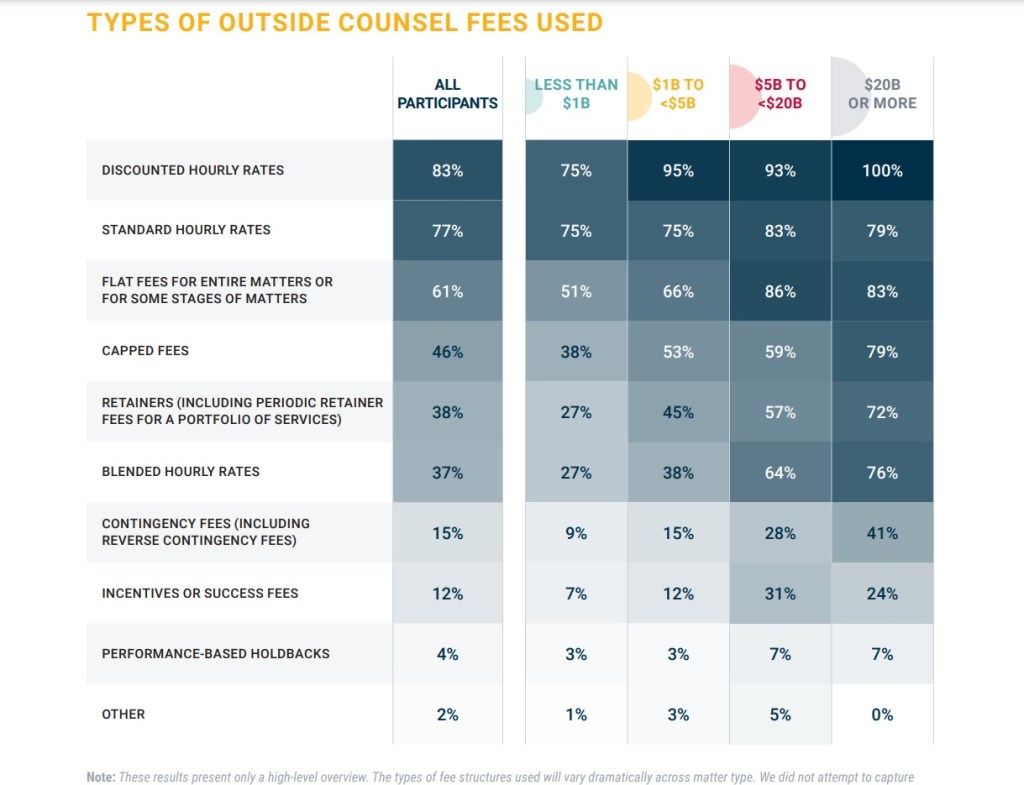

If you are wondering what types of Alternative Fees Arrangements (AFAs) in-house General Counsel are asking their private practice suppliers to provide them with – or, to flip the coin, what AFAs private practice lawyers are charging their in-house GCs, then wonder no longer. The latest market report from the Association of Corporate Counsel (ACC) sets this out in a nice clear table:

Some take-aways:

- The #1 AFA fee request of outside counsel is Discounted Hourly Rates. No less than 100% of companies with revenue over $20BN or more use Discounted Hourly Rates with their private practice lawyers! When, oh when, will we learn that Discounted Hourly Rates are NOT a fee structure? On this point, I have been arguing for years (literally, the linked post was from 2018!) that there is no point having a pricing function in your law firm if all you are going to offer clients is discounted hourly rates! Seriously, save yourselves the money.

- Say what you want, the #BillableHour is far, far from over if it is the preferred billing method of over three-quarters (77%) of all in-house GCs participants in the survey!

- Capped fees are dumb! They are a lose-lose: both for the law firm who if they come under the cap can only charge what is on the clock and if they go over the cap have to wear the additional cost; but also for the in-house team who will get under served as soon as it becomes clear the cap cannot be met (and probably never was going to be). So why are they so prevalent? I can only assume capped fees are driven by the CFO wanting “cost certainty”.

- Given the continued popularity of hourly rates, Blended Hourly Rates are nowhere near as popular (at 37%) as you would think. On transactional matters in particular, you would think this rate of use would be a lot higher.

- The use of Success Fees is woeful. Is this a reflection of the amount of M&A and privatization work actually being done (where you would expect it to be prevalent, or is it an actual fact that in-house counsel don’t like/understand the benefits of this arrangement? Or could it be, every deal is getting done so why take the uplift risk?)?

- An understanding of Performance Based Holdbacks has a long, long way to go.

Importantly though, despite talking about implementing AFAs for over two decades, we are still a long way off actually using them in practice.

Again, take a look at my linked article above where I talk to Patrick Johansen’s Continuum of Fee Arrangements™, where Patrick sets out 16 different types of fee arrangements that can be used:

- Hourly

- Volume

- Blended

- Retainer

- Capped

- Task

- Flat

- Phase

- Fixed

- Contingency

- Portfolio

- Hybrid

- Holdback

- Risk Collar

- Success/Bonus

- Value

And ask yourself, how many of these are being actively used in this latest report from the ACC?

Notably missing from the list above? Value Based Billing!

Yes, despite what you may read and hear elsewhere, in practice we are long, long way away from understanding and implementing the appropriate (a term I learned from Toby Brown) use of relevant fee arrangement for the task at hand.

In-house or private practice, if you’re struggling to get to grips with this issue, feel free to reach out to me for a chat.