Clio’s 2025 Legal Trends Report for Mid-Sized Law Firms provides a comprehensive look at how mid-sized law firms in the US are adapting to industry changes; particularly as it relates to AI adoption, billing models, client acquisition, and technology investments.

Although the results are based on data from US-based firms, the results are arguably applicable here in Australia and more broadly so here’s a summary of the key takeaways:

🚀 AI Adoption & Transformation

- Mid-sized firms (20+ employees) are now leading AI adoption in legal tech, surpassing smaller firms.

- 93% of surveyed professionals in these firms use AI, with 51% using it widely or universally.

- Common AI tools include legal research platforms, document automation, eDiscovery, and predictive legal analytics.

- AI is viewed as a way to increase efficiency, reduce costs, and improve client engagement.

💰 Billing Models & Pricing Trends

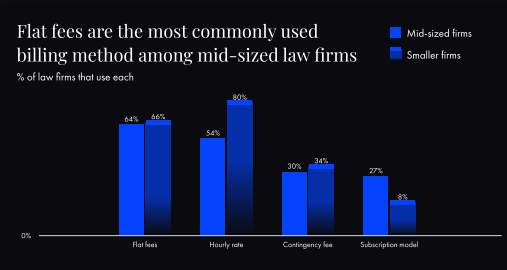

- Flat fees are now the most common billing method among mid-sized firms, outpacing hourly rates.

- Firms are shifting away from hourly billing due to AI’s impact on time-based work and client preference for predictable pricing.

- Subscription models are also gaining traction, especially for ongoing legal services to business clients.

- Despite the shift, hourly billing remains prevalent, particularly with highly varied rates by role and experience.

📈 Client Acquisition & Marketing Strategies

- Mid-sized firms use multiple marketing channels: websites, SEO consultants, social media, online reviews, and referrals.

- They’re less reliant on referrals than smaller firms, but invest more in digital marketing.

- Tools like e-signatures, intake forms, and online scheduling directly improve conversion rates and revenue (up to 20% higher).

- Chatbots are underused despite 51% of clients finding them helpful—a missed opportunity.

💸 Spending & Technology Investments

- Staff salaries dominate expenses (41%), followed by rent, marketing, and office costs.

- Mid-sized firms spend less on office expenses (5%) than solo and smaller firms, due to economies of scale and flexible work arrangements.

- Spending on software and professional fees is rising rapidly—showing a strong focus on tech and professional development.

☁️ Cloud Technology Adoption

- Mid-sized firms lag behind smaller firms in cloud adoption (only 38% vs. 71%).

- Firms with 20–49 employees are more likely to use cloud tools than larger mid-sized firms.

- Hesitation around switching legacy systems or internal decision-making bottlenecks may be holding back adoption.

🧭 Strategic Takeaways

- Mid-sized firms embracing AI + modern billing models + tech investments are poised to outpace competitors.

- The real threat isn’t automation—it’s firms that adapt faster.

- Cloud-based tools, client intake tech, and AI are critical for efficiency, growth, and client satisfaction.

You can download the full report here.

Get in touch if you want to discuss the outcomes of this Report or need assistance with your strategy.

📩 richard@gsjconsulting.com.au