The recently published 2025 EY Law General Counsel Study reveals how corporate in-house legal departments are responding to major external disruptions—ranging from geopolitical instability and regulatory complexity to technological transformation—to drive confident innovation.

While these trends demand agility and modernisation in legal operations and risk management, internal barriers like budget limitations and resistance to change often slow progress.

📊 Key Findings

1. 🌐 Legal Teams Face Rising External Pressures

In-house legal departments identify three major disruptors shaping their strategies:

- 🌍 Geopolitical uncertainty (76%)

- 📜 Complex regulatory environments (75%)

- 💡 Rapid technology evolution (74%)

These factors are pushing legal teams to rethink their approaches to compliance, governance and operational efficiency.

2. 📉 Internal Budget Pressures Persist Despite Growth Expectations

- 📈 83% of legal departments expect budget increases in 2025.

- However, 87% cite cost control as a top priority 💰

- 61% point to limited budgets as a significant hurdle in optimizing legal sourcing strategies 💼

🚀 Strategic Recommendations

1. 🧠 Gain Deeper Operational Insights

Engaging stakeholders and assessing operational maturity enhances planning and execution. Yet only 11% of departments conducted stakeholder interviews last year—an untapped opportunity.

2. 💵 Optimize Legal Spend and Increase Transparency

With only 24% completing recent spend assessments, legal departments should:

- 🔍 Analyze spend in detail

- 💳 Consider chargebacks

- 📊 Improve transparency and financial oversight

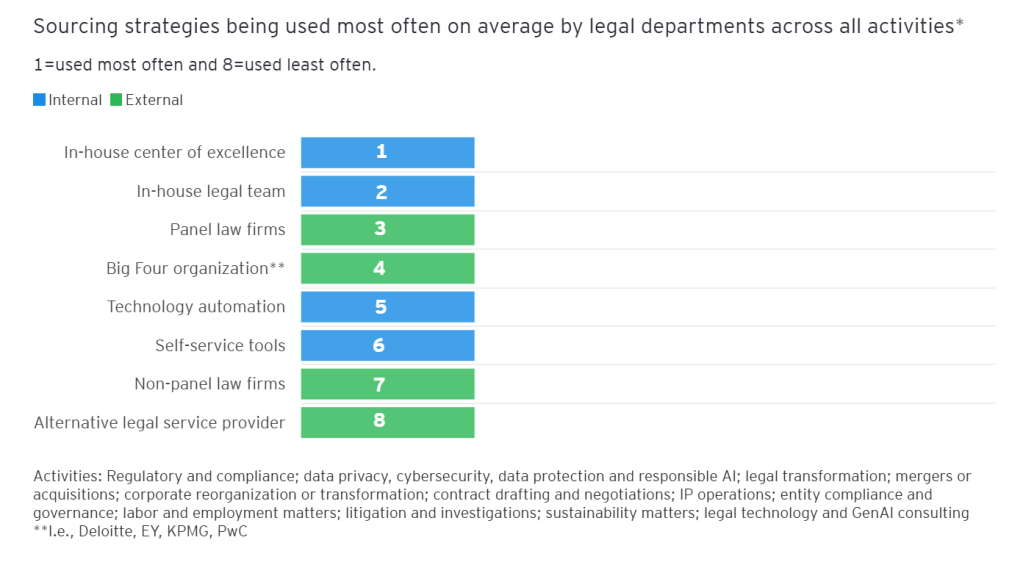

3. 🤝 Embrace a Diversified Legal Sourcing Model

To increase agility and expertise:

- Legal teams are tapping into Alternative Legal Service Providers (ALSPs) ⚖️

- 60% plan to increase ALSP usage in the next year ⏩

4. 🧑🏫 Invest in Legal Talent Development

With 64% prioritizing upskilling and reskilling, focus areas include:

- 🌱 Employee well-being

- 🧭 Career development

- 🎯 Talent retention

5. 📏 Align Risk Management Across the Enterprise

Fewer than 50% have a clearly defined risk governance model:

- 🤝 Cross-functional collaboration is essential

- ⚠️ Clear standards and risk tolerance must be established

6. 🤖 Leverage Legal Technology and Emerging Tools

While 75% aim to refine their legal tech strategies, only 25% prioritize Generative AI (GenAI):

- 📈 Opportunity to automate tasks like contract review and compliance

- 🧩 Build a tech roadmap that aligns with business goals

🏁 Conclusion

The 2025 EY Law General Counsel Study highlights the urgency for legal departments to adapt amid growing complexity.

By embracing innovation in sourcing, talent, tech, and governance, legal teams can build more agile, efficient, and future-proof operations.