The latest Law Society (England and Wales) Financial Benchmarking Survey has sparked significant discussion on social media today. The findings highlight some critical financial challenges for mid-sized law firms, particularly in terms of profitability, chargeable hours and cash flow management.

📊 Top 3 Key Findings:

1️⃣ Fee Earners’ Costs vs. Fees Charged

- The median hourly cost of a fee earner (based on 1,100 chargeable hours) was £123.40, while the median hourly fees per fee earner stood at £133.01.

- 🔴 93% of fees earned are being used to cover costs, leaving minimal margin for profitability.

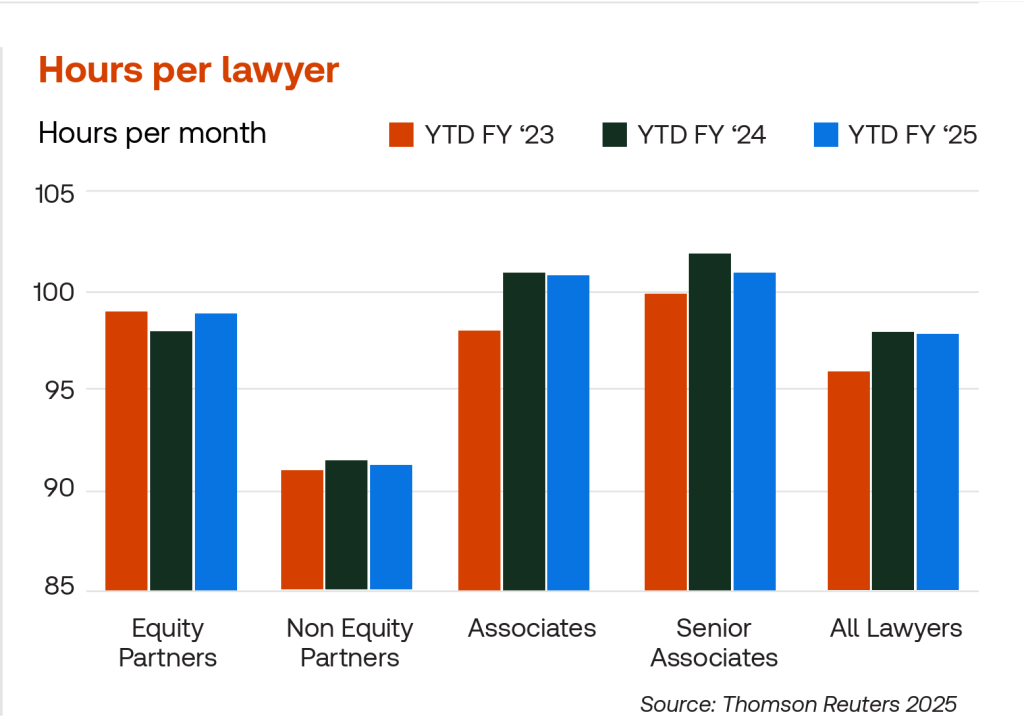

2️⃣ Shortfall in Chargeable Hours

- The average recorded chargeable hours per fee earner increased slightly to 773 hours (up from 765 in 2023).

- ⚠️ However, this is still well below the 1,100-hour target—a shortfall of over 300 hours per year per lawyer.

3️⃣ Increase in Lock-Up Days

- Year-end lock-up days (including work in progress and debtors) rose from 143 to 146 days.

- This trend indicates longer cash flow cycles, which can put pressure on a firm’s financial stability.

🚨 What Should Law Firms Do?

These figures underscore the urgent need for better financial planning, sustainable profitability strategies, and operational efficiency. Some key focus areas include:

✔️ Improving revenue streams—exploring retainer-based models for better income predictability.

✔️ Enhancing productivity—have a robust and actionable business development plan for all lawyers!

✔️ Optimise cash flow—reduce lock-up days by streamlining billing and collections processes.

🔗 Full Report: Read the Law Society Financial Benchmarking Survey 2025

📢 Looking to bridge the 300+ hour gap per lawyer? Or interested in strategies for growing a profitable legal practice sustainably? Let’s talk! Get in touch today.

rws_01

richard@gsjconsulting.com.au